EThICS-EU Project

End-to-End Analysis of Supply Chains to:

Develop Alternative Scenarios for Supply Security

Quantify Economic Impacts on Health Systems

Offer Policy Recommendations for Enhancing Supply Chain Resilience

Learn more about:

Project Phases

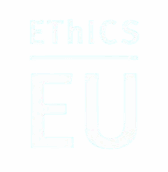

The project was split into different phases. Their descriptions can be found below:

1

Create Transparency for important Supply Chain

- Supply Chain Footprint

- Pipeline Inventory and Safety Buffers

- Opportunities for Substitution

- Potential Diruptions and Bottlenecks

2

Execute Stress Tests for these Supply Chains

- Generate and simulate disruptions at various stages/nodes of the global supply chains

- Determine the time-to-survive (TTS): The time until pipeline inventory/buffers are exhausted and severe negative health impacts are likely

3

Develop short, medium and long-term resilience-enhancing strategies

- Option 1: The preferred option

- Creating resilient supply chains for critical medicines that can mitigate both short-term and long-term risks

- We evaluate bundles of medium-term and long-term measures, e.g. decentralized safety buffers or alternative supply contracts

- Option 2: The fallback option

- Basic Emergency plan catering to long-term supply risks

- Creation of Emergency playbooks

- Individual steps include identifying available and reactivatable production infrastracture or critical supply assessment

4

Develop framework concepts

- Based on the results of Phases 1-3, we will develop two concepts that enable policy makers and managers to identify the most appropriate measures for enhancing supply chain resilience (Option 1) or creating emergency plans for major supply chain disruptions (Option 2).

- The framework concepts will take into account the specific features of the drug under consideration

- The key objective lies in the development of a pool of instruments and meaures that can be tailored to the specific features of individual drugs and the requirements of the population.

- We aim to establish these framework concepts as a standard for the assessment of supply chains for essential meicines.

Preliminary Findings

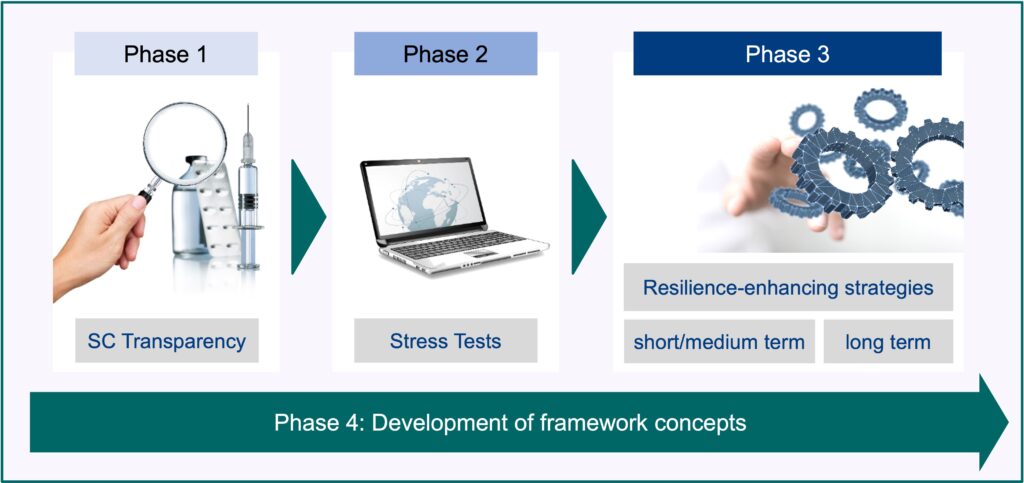

Generally, a low attractiveness of the pharmaceutical market could be observed. In Germany, that market is highly regulated. One aspect of this is fixed prices and price ceilings for prescription-only medicinal products. Also, the discount agreements between the statutory health insurance companies and the pharmaceutical companies are often criticized.

Why is this the case? Aren’t regulated pharmaceutical prices good for consumers and therefore to be welcomed?

One could say that this depends on whether a pharmaceutical product is still patented or available as a generic variant. Patented pharmaceuticals usually have large profit margins, but generic pharmaceuticals usually do not. When companies then also have to commit themselves to these discount agreements, they have little room left to manoeuvre between production costs and selling price.

This makes the market for these generic drugs unattractive, even though generic drugs are just as essential for the public well-being as patent-protected drugs!

1

Systematic Undersupply of Markets

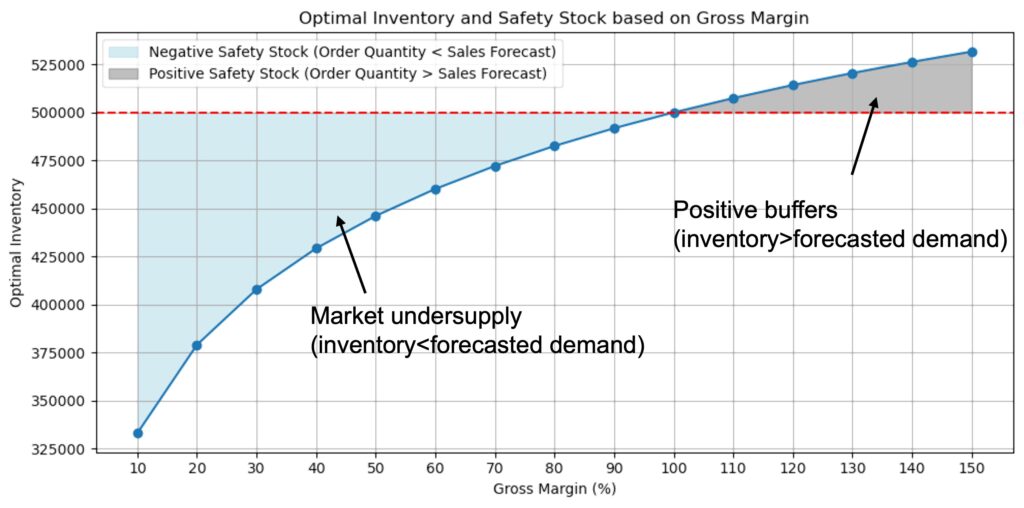

One result of the low market attractiveness is that companies have incentives to undersupply the market. Given an illustrative forecasting scenario, it can be shown that with margins below 100%, it is optimal for companies to have a negative safety stock, i.e. to undersupply the market.

Assumptions:

- Excess quantities are disposed of

- Production costs: €1.70/Unit

- Sales Forecast: 500,000 units

- Forecast Uncertainty: 20 %

No safety stock = No buffer inventory to cope with demand variations in the short- and medium-term

2

Market Contraction – Unhealthy Markets

Another result of the low market attractiveness is the observable market contraction, i.e. the shrinking number of competitors. Fewer competitors mean that markets can increasingly be characterized as oligopolies or even duopolies. Examples of market contraction in Germany include the breast cancer medication Tamoxifen or the pain medication Ibuprofen, especially in the form of fever syrups.

Fewer market participants = Fewer compensation potentials in case of disruptions

3

Offshore supply chains (Asia)

Probably the most prominent result of a lower market attractiveness are offshore supply chains, with essential nodes of pharmaceutical supply networks being located in Asia. These essential nodes are mainly producers of the active pharmaceutical ingredients (APIs).

The widespread offshoring of API production can be observed for several medications, e.g. for the antibiotics Amoxicillin, Cephalosporine and Colistin, as well as for the pain medication Ibuprofen. Our transparency analyses revealed the following API market shares per country:

| Pharmaceutical | API | Market Shares |

|---|---|---|

| Amoxicillin | 6-APA | China: 88.5% Austria: 6.56% Mexico: 4.9% |

| Cephalosporine | 7-ACA | China: 94% India: 6% |

| Colistin | Colistimethate Sodium (CMS) | China: 2 producers Denmark: 1 producer |

| Ibuprofen | Ibuprofen | India: 56.1% China: 21.8% USA: 21.1% |

But why is this the case? It largely comes down to the production costs. This can for example be illustrated with Amoxicillin: Looking at the total production costs, a large percentage stems from the material costs for procuring the API, making them highly influential on the final costs. And what are the most important factors determining the cost of an API? Labour, energy and wastewater treatment; all of which are cheaper in Asia.

- Yes, European producers often have productivity advantages compared to, for example, Chinese producers; but even if you consider this, labour is still cheaper in Asia.

- Wastewater treatment is also a big factor, especially in antibiotics production. In Europe, there are many regulations aiming to prevent contamination and the spread of antibiotics resistances in the environment. In China, this is not the case, making regulation compliant production of Amoxicillin in Europe about four-times as expensive.

To summarise: The need to reduce costs to stay competitive in an unprofitable market drives supply chains to Asia, making Europe’s API supply very Asia dependent. And this dependence goes further, as the suppliers of the API producers also procure vast amounts of their raw materials from Asia, as is the case for Ibuprofen. For example, 90 % of Isobutylbenzene (IBB), which is necessary for the production of the Ibuprofen API, comes from India.

Dependence on Asian API production = High logistical and political disruption risk